Mobile Notary vs Credit Union Notary

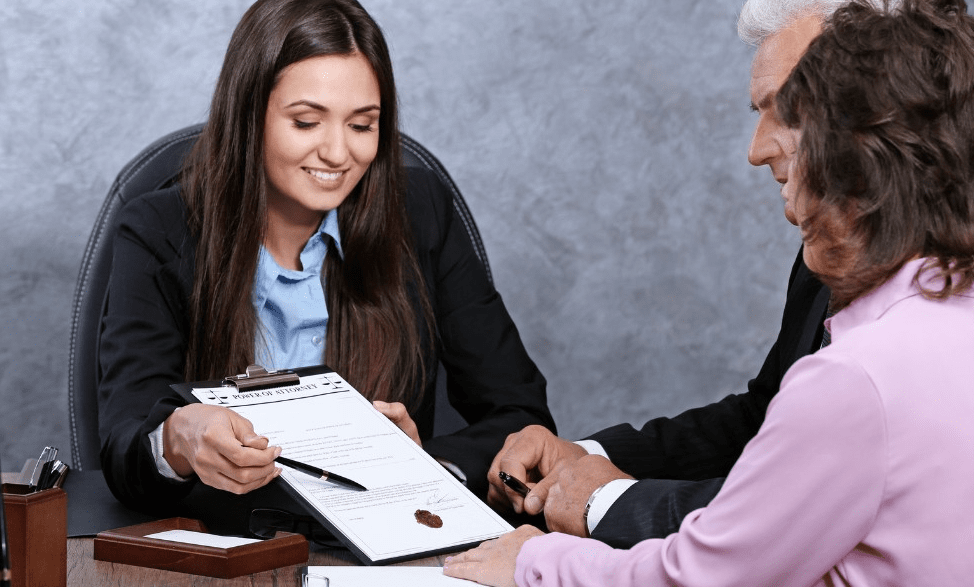

Mobile Notary vs. Credit Union Notary: Which is right for you? Discover the unique benefits of each, including convenience, cost, and service variety, for all your mobile notarization needs.

Las Vegas Mobile Notary

Rated #1 Best Las Vegas Mobile Notary Service

& A Locally Owned Notary Business

Instant Price Quote

Get it done right the first time or your $$$ money back 100% Guarantee!!!

Enter Your Info Below to Get a Call Back from a Certified Mobile Notary in Under 5 Minutes!

We accept all forms of payment

Mobile Notary vs. Credit Union Notary: Tracing the Evolution from Present to Past

Mobile Notary vs. Credit Union Notary: Tracing the Evolution from Present to Past

The notarial landscape today is defined by the distinct but interconnected roles of mobile notaries and credit union notaries. This exploration starts with their current roles in society and traces back to their historical origins, focusing on how they have adapted to changing times while remaining anchored in traditional practices.

The Role of Mobile Notaries Today

In our fast-moving, globalized society, mobile notaries have become increasingly significant. They serve clients needing notarial services at various locations and times, offering flexibility and convenience for those with busy lifestyles or those who can't easily travel.

Credit union notaries continue to play a vital role, especially within the framework of traditional banking institutions. They are a trusted option for clients preferring to conduct notarial transactions in a familiar and secure banking environment.

The Development of Mobile Notaries

The emergence of mobile notaries was a response to the evolving needs of a society that demanded more flexible and accessible notarial services. This development signified a shift towards accommodating the dynamic nature of modern personal and business transactions.

While adapting to contemporary needs, credit union notaries have maintained their traditional role within the banking sector. Their services have been a constant, blending financial service with a commitment to community needs.

Tracing the roots of the notary public takes us back to ancient Rome, with roles such as 'scribae', 'tabelliones', or 'notarii'. Originally focused on record-keeping, these positions evolved over centuries to include the authentication and certification of documents, laying the foundation for today's notary public.

The paths of mobile and credit union notaries, from their current roles back to their historical origins, depict an intriguing story of adaptation and persistence. While they have evolved to meet the demands of today's world, they continue to be grounded in practices established long ago. As societal needs shift, the roles of these notaries are likely to evolve further, continuing their legacy in the sphere of legal and official documentation.

Las Vegas Mobile Notary. What makes us different?

1. We come to you!

2. No trip to the notary office

3. We are available evenings and weekends

4. We are convenient and save you time

5. Get your documents notarized without leaving your home or office

6. We are experienced, reliable, and professional

7. Our prices are competitive

If you're looking for a mobile notary in Las Vegas, look no further than Las Vegas Notary 247. We provide convenient, professional, and reliable service when and where you need it. Our prices are competitive and we offer evening and weekend appointments to fit your schedule.

Always Available Mobile Notary. 24/7 Service. Our Mobile Notaries Are Licensed, Bonded, and Insured. Mobile Notary To You In Under 1 Hour. Fast Response Time. No Walk-In Service. Trustworthy Company. Over 10+ Years of Experience.

Types: Medical Durable Power of Attorney, Durable Power of Attorney, Financial Power of Attorney, Legal Docs, POAs, Jurats, Trust, Bill of Sales, Affidavits, Loan Agreements, and Deeds.

Looking for a mobile notary?

Mobile Notary locations

We offer a wide range of mobile notary services, including but not limited to:

Powers of Attorney, Affidavits, Acknowledgments, Oaths, and Affirmations, Medical Durable Power of Attorney, Living Wills, Durable Power of Attorney for Finances, Bill of Sale, Loan Documents, Mortgage Documents, Refinancing & Lines of Credit HELOC, Minor (Child) Travel Consent Form, Passport Application Documents, Certified Copies of Documents, Employment Contracts, Commercial Leases.

We are licensed, bonded, and insured. We have $100,000 in errors and omissions insurance and a $2,500 surety bond. We follow all state and federal laws regarding notarizations. We also use the latest technologies to ensure the safety and security of your documents. All of our notaries are background checked and undergo extensive training.

If you need a mobile notary in Las Vegas or Henderson, please call us at (725) 228-8288. We look forward to serving you!

We pride ourselves on being the most convenient, professional, and affordable mobile notary service in Las Vegas. We are bonded and insured. We use the latest technology to make sure your documents are properly notarized. And we have a 100% satisfaction guarantee.

Las Vegas Mobile Notary is a professional mobile notary service that comes to you. We are available 24 hours a day, 7 days a week to notarize your documents. We have a team of experienced and certified mobile notaries who are dedicated to providing the highest quality of service.

Questions and Answers: Mobile Notary vs Credit Union Notary

Q1: What is the main difference between a mobile notary and a credit union notary?

A1: The primary difference lies in their mode of operation. A mobile notary travels to the client's location, offering convenience and flexibility. In contrast, a credit union notary operates within a credit union branch, requiring clients to visit their physical location.

Q2: Which is more convenient, a mobile notary or a credit union notary?

A2: Convenience largely depends on the client's needs. A mobile notary is more convenient for those who prefer notarization services at their chosen location and time. However, for clients who frequent their credit union or prefer conducting transactions in a banking environment, a credit union notary might be more convenient.

Q3: Are mobile notaries more expensive than credit union notaries?

A3: Generally, yes. Mobile notaries often charge more to cover their travel and time expenses. Credit union notaries might offer lower or standardized fees, and sometimes these services are provided at reduced rates or free for credit union members.

Q4: Can both mobile and credit union notaries notarize all types of documents?

A4: Yes, both mobile and credit union notaries are typically authorized to notarize all documents that fall within their legal purview. However, it's always best to check in advance, especially for more specialized or uncommon documents.

Q5: How do I choose between a mobile notary and a credit union notary?

A5: The choice depends on factors like your location, availability, type of document to be notarized, urgency, and budget. If you need notarization services outside of regular business hours or at a specific location, a mobile notary is ideal. If you prefer a more cost-effective option and don't mind visiting a credit union during its operating hours, a credit union notary would be suitable.

Q6: Is the notarization by a mobile notary as legally valid as that by a credit union notary?

A6: Absolutely. The legal validity of a notarization does not depend on the type of notary but on the notary's compliance with state laws and procedures. Both mobile and credit union notaries are fully authorized to perform legal notarizations.

Q7: Do mobile notaries offer services outside of regular business hours?

A7: Yes, one of the main advantages of mobile notaries is their flexibility, including availability outside of standard business hours. This makes them a convenient option for urgent or time-sensitive notarizations.

Q8: Can I find mobile notary services in rural or remote areas?

A8: Yes, many mobile notaries serve rural or remote areas, although availability and travel fees can vary. It's advisable to check with local mobile notaries regarding their service areas and fees.

Q9: Are there any documents that a credit union notary can't notarize but a mobile notary can?

A9: Generally, the type of documents a notary can notarize doesn't depend on whether they are mobile or based in a credit union. However, some credit unions may have policies restricting certain types of notarizations due to internal regulations, while mobile notaries typically do not have such restrictions.

Q10: How does the confidentiality of documents compare between mobile notaries and credit union notaries?

A10: Both mobile and credit union notaries are bound by law to maintain confidentiality. However, mobile notaries might offer a higher degree of privacy due to the one-on-one nature of their service in a client-chosen environment.

Q11: Can mobile notaries provide services on weekends and holidays?

A11: Many mobile notaries offer services during weekends and holidays, catering to clients who need notarization services outside of traditional working hours. It's always best to check availability in advance.

Q12: Is it necessary to be a member of a credit union to use their notary services?

A12: This varies by credit union. Some credit unions offer notary services only to their members, while others may provide services to the general public. It's advisable to contact the credit union directly for their specific policy.

Q13: How do I find a reputable mobile notary?

A13: To find a reputable mobile notary, you can search online directories, ask for referrals from legal or financial professionals, or check with notary associations in your state. Reading reviews and checking their credentials is also recommended.

Q14: Are there any additional benefits to using a credit union notary?

A14: One additional benefit of using a credit union notary is the potential for a more integrated financial service experience, as some credit unions might offer additional advice or services related to your financial or legal needs.

Q15: Can a mobile notary refuse to notarize a document?

A15: Yes, a mobile notary, like any notary, can refuse to notarize a document if it does not meet legal requirements, if the signer cannot be properly identified, or if the notary suspects fraud or coercion.

Q16: How far in advance do I need to schedule an appointment with a mobile notary?

A16: This depends on the mobile notary's schedule. Some may offer same-day services, while others might require advance notice, especially during busy periods or for travel to remote locations.

Q17: What should I prepare before my appointment with a mobile notary?

A17: Before your appointment, ensure you have the document to be notarized, a valid form of identification, and any witnesses required. Also, be prepared to pay the agreed-upon fee.

Q18: Are mobile notary services available for businesses and corporations?

A18: Yes, mobile notaries commonly provide services to businesses and corporations, offering convenience for notarizing business-related documents at offices or other corporate locations.

Q19: Do mobile notaries have specific areas they serve, or can they travel anywhere?

A19: Mobile notaries typically have specific areas they serve, primarily based on their location and willingness to travel. The distance they are willing to cover can vary, and they may charge additional fees for longer distances.

Q20: In what situations would a credit union notary be preferred over a mobile notary?

A20: A credit union notary might be preferred when notarization is needed during regular banking hours, for clients who are already visiting the credit union for other services, or when seeking a more cost-effective option.

Q21: Can a mobile notary assist with notarization in a language other than English?

A21: Some mobile notaries are multilingual or specialize in notarizing documents in languages other than English. It's important to inquire about this beforehand to ensure proper communication and understanding of the document.

Q22: Is there a difference in the speed of service between mobile notaries and credit union notaries?

A22: Mobile notaries might offer faster service, especially if they provide same-day or next-day visits. Credit union notaries may have longer wait times, depending on the credit union’s customer traffic and appointment availability.

Q23: How does one verify the credentials of a mobile notary?

A23: To verify a mobile notary’s credentials, you can ask to see their notary commission certificate, check with the state's notary public administrator, or look up their credentials online if the state provides a database for such information.

Q24: Are mobile notary services available for real estate transactions?

A24: Yes, many mobile notaries are equipped to handle real estate transactions, including notarizing documents for home purchases, sales, refinances, and property transfers.

Q25: What kind of identification is required for notarization by a mobile or credit union notary?

A25: Typically, a government-issued photo ID, such as a driver's license, passport, or state ID card, is required. The ID should be current or issued within the last five years.

Q26: Can mobile or credit union notaries provide legal advice related to the documents they are notarizing?

A26: No, notaries, whether mobile or based in a credit union, are prohibited from providing legal advice unless they are also licensed attorneys. Their role is to witness the signing of documents and verify the identity of signers, not to advise on legal matters.

Q27: What happens if a document is not properly notarized?

A27: If a document is not properly notarized, it may be considered invalid for legal purposes. This could lead to legal disputes or the need for re-notarization. It's crucial to ensure that the notary follows all legal procedures correctly.

Q28: Are mobile notaries available for emergency or last-minute notarization needs?

A28: Yes, many mobile notaries offer emergency or last-minute services. However, this may come with additional fees, and availability can vary based on the notary's schedule.

Q29: How long does a typical notarization appointment last with a mobile notary compared to a credit union notary?

A29: The duration of a notarization appointment can vary depending on the document's complexity. Mobile notaries might offer quicker sessions since they are focused on a single client. Appointments at credit unions may take longer, especially if there's a wait time due to other bank customers.

Q30: Do credit union notaries also travel to client locations?

A30: Generally, credit union notaries do not offer mobile services. Their services are usually confined to the credit union’s premises. Clients needing mobile services should specifically seek out a mobile notary.

Q31: Can a mobile notary notarize a document for someone in a hospital or nursing home?

A31: Yes, mobile notaries often provide services in hospitals, nursing homes, and other healthcare facilities. This is particularly useful for individuals who are unable to travel due to health reasons.

Q32: Are there any specific security measures that mobile notaries take when handling sensitive documents?

A32: Mobile notaries are expected to adhere to high standards of confidentiality and security. They should handle all documents with care and ensure the privacy of the signing process. Some may use secure cases or bags for transporting documents.

Q33: What should I do if I need a notary after regular business hours and on weekends?

A33: If you need notarization services outside regular business hours or on weekends, your best option is to contact a mobile notary. They typically offer more flexible scheduling compared to credit union notaries, who are bound by the credit union's operating hours.

Q34: How do I ensure the mobile notary coming to my location is legitimate and trustworthy?

A34: You can ensure a mobile notary's legitimacy by asking for their notary identification number and verifying it through your state's notary regulatory office. Also, check for reviews or testimonials from previous clients.

Q35: Are there limitations to the types of payments mobile notaries accept compared to credit union notaries?

A35: Mobile notaries may offer a variety of payment options, including cash, credit/debit cards, and sometimes digital payments. Credit union notaries, being part of a banking institution, might have more standardized payment methods.

Q36: Can a mobile notary provide services for individuals with disabilities?

A36: Yes, mobile notaries can provide services for individuals with disabilities. Their ability to travel to the client’s location makes them particularly suited for clients who may have mobility or transportation challenges.

Q37: Is there a maximum distance a mobile notary is willing to travel?

A37: The maximum distance a mobile notary is willing to travel varies by individual. Some may have a set service area, while others might be willing to travel further for an additional fee. It’s best to discuss this with the notary beforehand.

Q38: Can credit union notaries refuse to notarize a document?

A38: Yes, credit union notaries can refuse to notarize a document if it does not meet legal standards, if the signer cannot be properly identified, or if they suspect fraud or duress. This is in line with the general legal obligations of all notaries.

Q39: What precautions do mobile notaries take to ensure the safety and health of their clients, especially in times of public health concerns?

A39: During times of public health concerns, mobile notaries may implement precautions such as wearing masks, using hand sanitizer, practicing social distancing, and sanitizing their equipment. Some may also offer contactless notarization options where legally permitted.

Q40: How does weather or extreme conditions affect mobile notary services?

A40: Weather and extreme conditions can impact mobile notary services, as they often involve travel. In cases of severe weather, a mobile notary may need to reschedule appointments for safety reasons. It's advisable to have a contingency plan for time-sensitive documents.

Q41: Do mobile notaries offer any additional services beyond notarization?

A41: Some mobile notaries may offer additional services such as courier services, apostille processing, or witnessing document signings. However, these services vary by individual notary and should be confirmed beforehand.

Q42: What types of identification are considered acceptable by both mobile and credit union notaries?

A42: Both mobile and credit union notaries typically accept government-issued photo IDs like drivers' licenses, passports, and state ID cards. The ID should be current or issued within a reasonable period.

Q43: Can a mobile notary help with international documents?

A43: Many mobile notaries can notarize documents intended for use in other countries. However, it's important to verify that the notary is familiar with the specific requirements for international documents, such as apostilles or consular legalizations.

Q44: How can I find a credit union notary near me?

A44: To find a credit union notary, you can start by contacting credit unions in your area. Most credit unions list their services, including notary services, on their websites. Additionally, a simple online search or phone call can provide this information.

Mobile Notary vs. Credit Union Notary: Navigating the Evolving World of Notarial Services

Key Insights:

- The choice between mobile notaries and credit union notaries is critical in the fast-paced business environment.

- Mobile notaries provide flexibility and convenience, adapting to the dynamic needs of modern businesses and individuals.

- Credit union notaries are synonymous with trust and tradition, often preferred for their stability and cost-effectiveness.

- As a business owner, understanding the nuances of each service is crucial for efficient and informed decision-making.

- The evolving landscape of notarial services reflects broader shifts in business practices and client expectations.

In the fluid and ever-changing business world, the significance of selecting the right notarial service cannot be overstated. As someone at the helm of a business, I've often found myself weighing the pros and cons of mobile notaries against those of credit union notaries. This decision, seemingly simple, can have far-reaching implications for business efficiency and the handling of legal or financial matters.

The emergence of mobile notaries marks a response to the burgeoning demand for agility and immediacy in both personal and professional realms. Their primary allure lies in their ability to offer services at a location and time of your choosing. This aspect of service delivery is particularly beneficial in scenarios where time constraints are tight or where clients or stakeholders are unable to travel. From my experience, the ability to summon a notary to my office or a client's location has been a game-changer, saving precious hours that would otherwise be lost in transit to a stationary notary.

However, this convenience provided by mobile notaries often comes with a higher price tag compared to traditional notarial services. For businesses, this cost is frequently justified by the efficiency and adaptability these mobile professionals bring to the table. They align seamlessly with the needs of a business environment where speed and flexibility are paramount.

Contrastingly, credit union notaries represent a more traditional approach in the notarial domain. Rooted in the trusted and familiar environment of credit unions, these notaries offer a sense of security and continuity that many business owners and individuals still value. Especially within the business community, those who prioritize long-standing relationships and the reassurance of a well-established financial setting tend to lean towards credit union notaries. The affordability of their services, particularly for credit union members, can be a significant advantage for businesses aiming to curb operational costs.

Yet, the traditional model of credit union notaries comes with its constraints. Their availability is limited to the credit union’s operational hours and locations, which can be a stumbling block for businesses that operate outside these time frames or are situated at a distance from a credit union branch. The inherent limitation in terms of flexibility can hinder a business’s ability to react swiftly to market opportunities or urgent requirements.

For a business owner, choosing between a mobile notary and a credit union notary is often a balancing act between cost, convenience, and trust. The decision hinges on the specific circumstances of the notarization, the urgency of the task, and the financial considerations at play. Sometimes the choice is straightforward, but often it demands a careful evaluation of the various factors involved.

Looking to the future, the field of notarial services is likely to keep evolving. The growing need for speed and flexibility suggests an increasing demand for mobile notary services. Meanwhile, credit union notaries are expected to remain a steadfast option for those who prefer the reliability and cost-effectiveness of traditional banking environments.

In summary, the comparison between mobile and credit union notaries isn't just about contrasting two types of services; it's about understanding how these services fit into the larger picture of modern business operations and legal processes. For business owners like me, adeptly navigating these choices is essential to maintaining efficiency and effectiveness in an increasingly interconnected and fast-moving business landscape.

Services Las Vegas Mobile Notary Provide

When you call las Vegas Notary for service we are not limited to just general notary work. We help with all documents that need to be notarized. Here are some examples of what we provide: Loan Documents, Real Estate Closings, Financial Documents, Structured Settlements, Last Will & testament / Legal Forms, Deeds / Property Transfers, Medical Forms / Documents, Power of Attorney, Jail Visits, Hospital / Hospice Visits. There are lots of other documents but these are the most popular.

We at Las Vegas Mobile Notary understand that your time is valuable. That's why we offer a mobile notary service that comes to you. Whether you're at home, at work, or even at the hospital, we can come to you and notarize your documents. Hospital calls are always given priority. We are available 24 hours a day, 7 days a week, 365 days a year. We also provide loan document signing for title companies and signing services for real estate agents. We have a team of professional notaries who are experienced in loan document signing and real estate closings. Local banks and credit unions also recommend us for notarizations. Plus we answer all calls for the local public of Las Vegas and Henderson for all general mobile notary needs. Here or some of the documents we can notarize for you.

We offer a wide range of mobile notary services, including but not limited to: Powers of Attorney - Affidavits - Acknowledgments - Oaths and Affirmations - Medical Durable Power of Attorney - Living Wills - Durable Power of Attorney for Finances - Bill of Sale - Loan Documents - Mortgage Documents - Refinancing & Lines of Credit HELOC - Minor (Child) Travel Consent Form - Passport Application Documents - Certified Copies of Documents - Employment Contracts - Commercial Leases

When you call las Vegas Notary for service we are not limited to just general notary work. We help with all documents that need to be notarized. Here are some examples of what we provide: Loan Documents, Real Estate Closings, Financial Documents, Structured Settlements, Last Will & testament / Legal Forms, Deeds / Property Transfers, Medical Forms / Documents, Power of Attorney, Jail Visits, Hospital / Hospice Visits. There are lots of other documents but these are the most popular.